CITIC Securities' solid-state battery research report interpretation: 2030 production demand 212GWh

Release time:2025-07-15

As a core direction for next-generation power batteries, the industrialization pace of solid-state batteries has always been a focal point for the new energy industry. CITIC Securities' in-depth research report, "Solid-State Batteries: Riding the Wave, Ushering in a New Chapter for Equipment," released on June 27, provides a systematic reference for the industry through full-industry-chain research and data calculation.

This report not only includes a detailed projection of global solid-state battery production demand in 2030, but also covers core content such as comparisons of solid-state and liquid-state battery process technologies, equipment selection in the pre-, mid-, and post-stages of solid-state battery R&D and industrialization, case studies of battery companies, and cost calculation models. It has significant reference value for those working in the new energy industry chain.

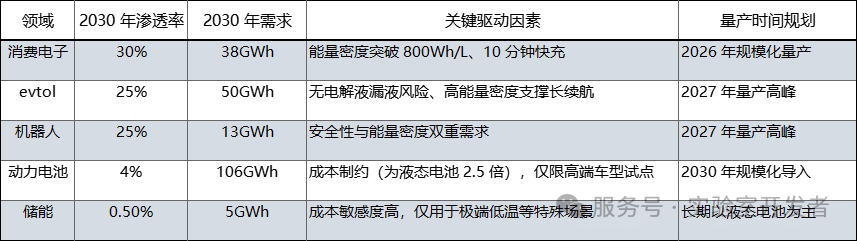

The report points out that in 2030, global demand for solid-state batteries will reach 212 GWh, with a penetration rate of 5.1% , showing significant differentiation among the four major fields of consumer electronics, eVTOL, power batteries, and energy storage, with consumer electronics and eVTOL becoming the first to achieve mass production and explosive growth.

The first-mover advantage in the consumer electronics field lies in the high demands of smart phones and wearable devices for battery energy density and fast charging performance, making solid-state batteries a necessary upgrade.

Its energy density exceeding 800Wh/L and 10-minute fast charging characteristics can significantly improve user experience. Report data shows that in 2030, the demand for solid-state batteries in the consumer electronics field will reach 38 GWh, with a penetration rate of 30%, meaning that 1 out of every 3 high-end devices will use solid-state batteries.

In terms of industrialization progress, different fields show significant differentiation, with the specific data as follows:

Applications in eVTOL and robotics are also worth noting. These scenarios have extremely high safety requirements, and the solid-solid interface characteristics of solid-state batteries are perfectly suited, with mass production expected to peak in 2027.

In contrast, the much-anticipated power battery field, while having a large demand scale, has a penetration rate of only 4%. The core constraint is cost; in the short term, it can only be pilot-applied in high-end models costing over 500,000 yuan.

Penetration in the energy storage field is even slower, as energy storage scenarios are highly sensitive to cost, and liquid lithium iron phosphate batteries will remain dominant for a long time.

The popularization of solid-state batteries will not happen overnight and depends on the upgrading of R&D production line equipment.

The report points out that by 2030, semi-solid-state batteries will still account for 51.3%. This transitional technology has good compatibility, requiring no large-scale modification of existing production lines, and its cost is 40% lower than that of all-solid-state batteries , and its energy density can meet the needs of mid-range devices, making it the mainstream choice in the early stages of mass production.

From the perspective of industrial opportunities, equipment suppliers in the consumer electronics and eVTOL fields are worth paying close attention to.

The report mentions that fiberizing equipment and laser die-cutting machines are core equipment for solid-state battery production lines , and the expansion pace of consumer-grade production lines is 2-3 years ahead of that of power batteries, resulting in a shorter performance realization cycle for related companies.

Potential risks to be aware of when adjusting to solid-state battery production lines

Currently, the cost of solid-state battery equipment is 30% higher than that of liquid-state batteries, the domestication rate of the key material PTFE is less than 20%, and the yield of pilot lines is only 60%-70%, all of which will affect the industrialization process.

Overall, the popularization of solid-state batteries will be a gradual process. CITIC Securities' report, with its solid data support and industry insights, provides a clear reference for the development path for industry professionals.

Companies looking to enter the solid-state battery market can focus on R&D equipment and materials related to dry-process electrodes, as the sound of mass production is already audible.

In addition to market analysis, this report also covers in-depth content on the improvement and selection of solid-state battery process equipment, including practical points such as dry-process electrode equipment optimization and laser die-cutting parameter adjustment. Due to space limitations, we will elaborate on this in our next special issue, helping you understand the core logic of solid-state battery mass production line equipment selection.

If you need to obtain a landing solution for solid-state battery dry-process electrodes, please scan the code to register for one-on-one communication and guidance with Wuhan Chaodian engineers.

Hotline: 027-8580 9599

Disclaimer: Some of the content and materials (including images) in this article are reproduced from online sources. The article does not represent the views of this platform and is for learning and exchange purposes only, not for commercial purposes. Copyright belongs to the original author. For any disputes regarding content, copyright, or other issues, please contact us via email cj017@spcmach.com. We will verify and respond within 24 hours. This article may not be reproduced without authorization. We will not bear any legal responsibility for any consequences arising from unauthorized reproduction.

Solid-state battery,Solid-state battery mass production,Solid-state battery research report,Mass production equipment for solid-state batteries,Dry battery technology

Related News

Focus on us